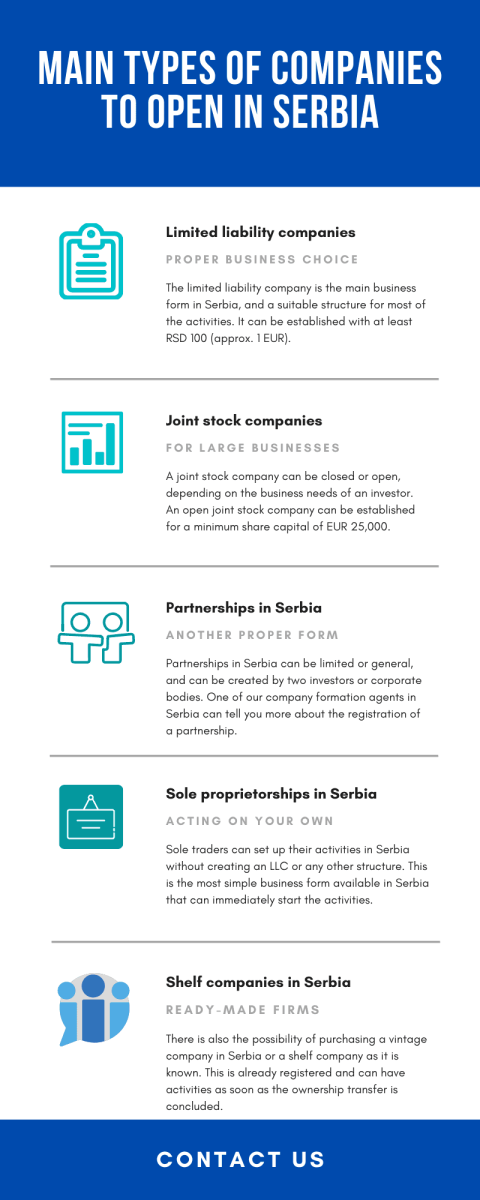

CompanyFormationSerbia.com provides the necessary instruments for company incorporation in Serbia. Before starting a business, the investors must be aware of the types of companies they can open in Serbia. Just like in any other European country, the investors who want to start a company in Serbia may choose any suitable form of business they want. There are the limited liability companies – private (d.o.o.) or public (a.d.) – and partnerships – general (o.d.) or limited (k.d.). Our company formation specialists in Serbia are at your disposal with complete support at the time of company registration in this country.

| Quick Facts | |

|---|---|

| Types of companies |

Limited liability company Joint-stock company General partnership Limited partnership Branches of foreign companies Sole proprietorship |

|

Minimum share capital for LTD Company |

RSD 100 |

|

Minimum number of shareholders for Limited Company |

1 |

| Time frame for the incorporation (approx.) |

3 weeks |

| Corporate tax rate |

15% |

| Dividend tax rate |

15% |

| VAT rate |

20%, a reduced rate of 10% also applies to certain goods |

| Number of double taxation treaties (approx.) | 61 |

| Do you supply a registered address? | Yes |

| Local director required | No |

| Annual meeting required | Yes |

| Shelf company available | Yes |

| Electronic signature | Yes |

| Is accounting/annual return required? | Yes |

| Foreign-ownership allowed | Yes |

| Any tax exemptions available? | corporate income tax exemptions for innovative companies |

| Tax incentives | Regional incentives |

What is a Serbian limited liability company?

The Serbian limited liability company (d.o.o.) is widely used for starting a business in Serbia, it is a legal entity where all the shareholders have a limited liability, based on their contributions and suitable for small and medium businesses. For a private limited liability company in Serbia, the founders must provide a minimum share capital of RSD 100 and this type of entity cannot be formed by more than 50 shareholders. According to the Company Act in Serbia, all shareholders of a limited liability company are liable for its earnings and debts. The major decisions of the Serbian D.O.O. are taken by the general meeting of the shareholders, while the daily decisions and the strict control on observing the articles of association are handled by a director. The following information is comprised by the Articles of Association, the main documents for company formation in Serbia:

- complete information about the owners (their names, the nationality, the country of residence);

- the address of the head office, the main activities;

- the objectives of the newly-formed company in Serbia, in accordance with the applicable legislation;

- details about the initial capital contribution which is kept in a temporary bank account.

How can I open a joint stock company in Serbia?

If the Serbian or foreign founders have a higher amount of money to invest in a business, they can incorporate a Serbian joint stock company (A.D.). There are two types of joint stock companies in Serbia:

– closed joint stock companies (where the founders must provide a share capital of at least 10,000 EUR and cannot have more than 100 shareholders),

– open joint stock company (with a minimum share capital of 25,000 EUR and more than 100 shareholders). Only the stocks of the open joint stock company can be registered with the Stock Exchange in order to increase the capital. The major decisions are also taken by the general meeting of the shareholders, while the daily ones are taken by a board of directors, controlled by a supervisory board. Here is an infographic that explains the registration of companies in Serbia:

How can I open a partnership in Serbia?

The Serbian general partnership is formed by two or more individuals or corporate bodies united under a partnership agreement and with a personality not separated from the one of the entity. No minimum share capital is necessary to run this business and the capital is usually stipulated in the partnership agreement. All the major decisions are taken by all the members and, in the case of liquidation, the personal assets of the members are not protected.

A Serbian limited partnership (K.D.) is similar to the above type of partnership, but it has two types of members: ones with unlimited rights and liabilities in the entity, called general partners, and at least one partner with rights and liabilities limited by the contribution at the partnership’s capital. There is no minimum share capital request for starting this type of company in Serbia.

The incorporation procedure in Serbia

A Serbian legal entity is based on the constitutive documents called articles of association which contain all the internal regulations and entity details. The founders of a Serbian company must elaborate these documents and must make sure that the chosen name is not already used by another entity. The articles of association or the partnership agreement must contain the address of the head office, the main activities, and objectives of the entity and the initial capital contribution (kept in a temporary bank account). This Memorandum of Association must be notarized at a basic court, at the Municipality or public notary. The registration at the Serbian Trade Register must be made before starting any commercial activity. Here are a few requirements for company formation in Serbia:

- the incorporation is made by submitting an application via e-mail or by visiting the institution;

- the founder must fill out the application for registration found on the Business Registration Agency website;

- in the same time with the registration certificate issued by the Serbian Business Registration Agency, the founder will also obtain a registration number and code of Republic Statistical Agency (RSA), a registration certificate from the Pension Fund (PIO fund) and one from the Health Fund;

- the registration with the tax authorities is necessary for obtaining a tax identification number and a VAT number.

This process is free of charge and it is made by submitting a form downloaded from the official tax authority website. If the entity will hire employees, it is mandatory to register those at the Employment Fund and, only after taking this step, the company may begin the processes specific to the business. Under the Law on Employment and Insurance in Case of Unemployment, any Serbian employer must submit an application on the vacancy for jobs with the National Employment Office.

Steps for company formation in Serbia

If you would like to register a limited liability company in Serbia, you should pay attention to the following steps:

- Prepare and draft the Articles of Association with information about the company and the owners.

- Appoint a representative for your business (talk to our specialists and ask for support in this matter).

- Fill out the application form for business registration with the Serbian Business Registration Agency.

- Open a bank account for the minimum share capital and for future financial operations.

- Apply for special licenses and permits before starting the activities in Serbia.

- Apply for the company’s seal and then register for tax purposes in Serbia.

Company formation costs in Serbia

It is important for foreign investors to have an idea about the business setup costs in Serbia. Here are a few costs to consider at the time you want to register a business in Serbia:

- Registration fee: approximately RSD 5,000 (EUR 43) is needed for registering a company in Serbia with the local Trade Register.

- Virtual office cost: approximately EUR 50 for a virtual office package for your business in Serbia.

- Minimum share capital: RSD 100 (approx. EUR 1) are needed for opening a limited liability company in Serbia.

- Company formation fee: around EUR 589, a reasonable offer from our company formation agents in Serbia.

- Accounting costs: starting from EUR 30, but for a personalized offer talk to our accounting consultants in Serbia.

What is the minimum share capital of DOO and AD in Serbia?

At least RSD 100 (one EUR) are necessary in order to open a private limited liability company (DOO), while for the registration of an open joint stock company (AD) EUR 25,000 are necessary, and EUR 10,000 for the closed joint stock company. Our team of advisors in Serbia can give you further details on this matter.

How quickly can I incorporate my company in Serbia?

The process of a Serbian company incorporation takes around 3 weeks if all the documents are properly submitted and on time. If you want to start a business in Serbia and need legal assistance for company incorporation, please send inquiries to our lawyers. They can also help you obtain the EORI number.

How easy is it to hire personnel in Serbia?

It’s not hard to find suitable candidates for the vacant places in the legal entities. The Serbian workforce is highly educated and has many skills. The main advantage of hiring personnel in Serbia is granting of an exemption on salary tax for the employer who hires certain categories of workers on a permanent contract for a period of two or three years. Also, the employers will not pay social security contributions over that period, for certain category of employees.

Shelf company in Serbia

Foreign investors who want to enter the Serbian market in a fast manner can purchase shelf companies. These ready-made companies in Serbia can suit most business needs of foreign entrepreneurs. A shelf company in Serbia comes with varied benefits among which less bureaucracy, as this is a registered company, an established bank account, a transparent background, and no debts. Please feel free to ask our team of specialists for extra details about shelf companies in Serbia.

The Companies Act in Serbia

The set of laws that stand at the base of company formation in Serbia, plus the regulations of doing business in this country is the Companies Act in Serbia. It comprises complete information about how a company can be opened in Serbia, depending on the chosen type of structure (LLCs, partnerships, joint stock companies), about the rights and liabilities of shareholders in the firm, about the share capital and about the ways in which an enterprise can close its operation at a certain point. Likewise, the Company Law in Serbia stipulates information about the commercial activities a specific company can perform. Having a permissive business legislation directed to the foreign investments for which varied improvements have been introduced by the government, Serbia aligns with important financial hubs all over the world that provide a proper business climate for numerous activities.

The Serbian Business Registers Agency

The incorporation process of a firm starts at the Serbian Business Registers Agency founded in 2005, and the requirements imposed. This is a one-stop-shop that provides complete company formation services, and which is sustained by the governmental efforts to ease the ways in which a business can be registered. The Serbian Business Registers Agency runs in complete attention to the business needs of both national or international entrepreneur by reducing the bureaucracy and the administrative matters involved in the registration procedure. Instead of dealing with possible misunderstanding, mostly because of the language barrier, we invite you to talk to our company incorporation experts in Serbia and find out how we can help with company registration in Serbia matters.

The willing of centralizing all the data from the previous registers led to one unitary Serbian Business Registers Agency (SBRA) founded in 2005. The agency was established in Serbia with the government’s help and also support from the World Bank, Microsoft, and USAID. The administrative sector became friendlier for the public and the budget was not affected at all since all the funds came from the registration fees (not changed from the first day the Register was founded). The founding of the Serbian Business Registers Agency was a result of the reforms implemented by the local government in the area of business registration and a registration system for financial leasing and pledge rights on movable assets. The main purposes of the Serbian Business Registers Agency are:

- to facilitate the setting up and closing of Serbian companies;

- to improve the business environment for larger foreign investments;

- to prepare the necessary bureaucratic conditions for generating new jobs;

- reducing administrative obstacles to doing business in Serbia.

Information offered by the Serbian Business Registers Agency

The Serbian Business Registers Agency operates as a single, centralized and public electronic database. It contains relevant information about all aspects related to doing business in Serbia, like the ones about:

- companies;

- entrepreneurs (sole traders);

- financial leasing contracts;

- pledges;

- associations operating within the country;

- foreign associations;

- representative offices of foreign endowments and foundations;

- information about construction permits;

- sporting associations, business companies, and sports federations;

- chambers of commerce;

- temporary restrictions on rights of entities;

- bankruptcy estates;

- bidders and injunctions.

How to check the information from the Serbian Registers Agency

If a company wants to obtain a copy of the registration, it needs to fill out an application and pay a fee in order to receive it. The certificate date may be found also in electronic format. The taxes that need to be paid for this service are established according to the complexity of the required data.

We can provide accounting services on request

Foreign investors who decide on having a business in Serbia without the intention of opening an accounting department should know that they have the possibility of externalizing such services with the help of our experienced accountants. In this direction, we provide support for payroll, VAT registration and filings, bookkeeping, financial annual statement, and varied tax minimization methods in compliance with the business needs. Also, your company with establishments in Serbia may benefit from tax planning and consultancy offered by our team of accountants in Serbia. We remind that our team performs the accounting services for your business in Serbia in respect to the International Financial Reporting Standards and the local legislation applicable in Serbia.

What is a virtual office in Serbia?

A virtual office in Serbia is a set of services destined for foreigners looking for other options instead of a traditional business office. This is subject to low costs and among the advantages of such a virtual office, we mention:

- a notable business address in Belgrade or any important city in Serbia;

- local phone and fax numbers linked to the new business in Serbia;

- call answering and message forwarding in compliance with the owners’ requests;

- the support of a meeting room for conferences and business consultations;

- collection of bank statements and any related documents which can be forwarded to the business person.

Economy overview in Serbia

With a strategic position in the central part of the Balkans, Serbia has a very encouraging market strategy. Serbian workforce is highly educated and cheap. Serbia has signed very attractive treaties with Western Balkans countries, USA, EU countries etc. It signed a free trade agreement with Russia, which allows access to over a 150 mil. consumers market. Special measures are taken to encourage foreign investors who want to establish subsidiaries in Serbia, like the special treatment granted to the entrepreneurs who invest in fixed assets, with a capital amount above EUR 8 million and hire more than 100 employees in the investment period. These companies are not paying the corporate tax for a period of 10 years. Serbia also has the smallest corporate tax rate all over Europe.

Double taxation treaties are signed with more than 50 countries. Serbia has become a candidate state to the European Union and specific measures are taken for reforming the state administration and public finances. Fiscal consolidation is another goal of the Serbian government, aimed at reforming state-owned enterprises (SOEs).

If you need more information about how you can open a company in Serbia, you can contact our company formation specialists in Serbia.