Opening branches in Serbia falls under the provisions of the Serbian Law on Companies. Even if it is not considered a legal entity, a foreign branch can perform legal transactions and activities in the name of the parent company on the Serbian territory. If you are a representative of a company from overseas who wants to establish a branch in Serbia, you can rely on complete help and guidance in this matter, which is offered by our specialists in company formation in Serbia.

| Quick Facts | |

|---|---|

| Applicable legislation |

For foreign countries |

|

Best used for |

– banking, – insurance, – financial activities |

|

Minimum share capital |

No |

| Time frame for the incorporation (approx.) |

Around 5 weeks |

| Management |

Local for non-EU companies |

| Legal representative required |

Yes |

| Local bank account |

Yes |

| Independence from the parent company | Dependent on the parent company |

| Liability of the parent company | Full liability on the branch office's debt and obligations |

| Corporate tax rate | 15% |

| Possibility of hiring local staff | Yes |

Table of Contents

Necessary documents for a branch in Serbia in 2024

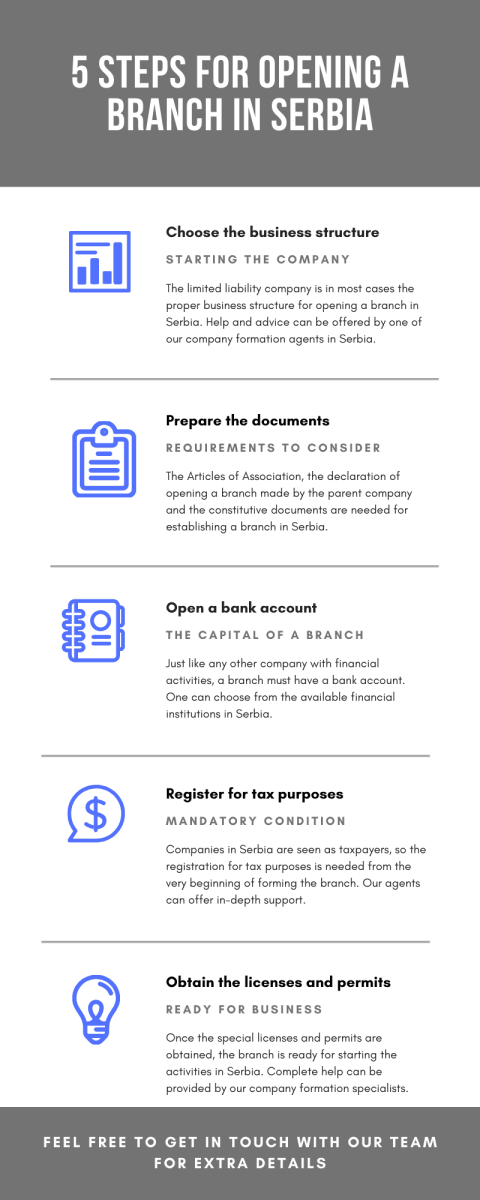

When registering a branch in Serbia in 2024, it is suggested to consider the following documents for submission to the Serbian Business Register Agency:

- the decision of opening a branch in Serbia issued by the parent company;

- the proof that the foreign company is registered in the country of origin;

- the certificate of registration and the constitutive documents of the parent company;

- the company’s articles of association with complete information about the owners;

- the list of the company’s management board’s members and supervisory board’s members;

- the name of the branch and the reason why it is opened;

- the name of the representative agent of the company and his/her rights.

All the above documents must be notarized and accompanied by the Serbian translation. As a result, the branch opened in Serbia will receive the registration certificate, the tax identification number and the certificate from the pension and health funds. Other requirements are to register with the tax authorities and with the Employment Organization Funds and to open a bank account for the future financial transactions.

Branches in Serbia can be registered with a minimum share capital of EUR 1, in approximately 5 weeks. At the same time, the bank account required for this structure can be opened.

What are the conditions for opening a branch in Serbia in 2024?

In accordance with the rules and regulations stipulated by the Companies Law in Serbia, a foreign branch represents a separate administrative division of a company that operates in other countries in compliance with the conditions imposed in those states. It is good to know that the Serbian Business Register Agency which oversees the company incorporation in the country, is also in charge of registering foreign branches. Among the information necessary for registration of your branch in Serbia, we mention that the documents must comprise details about the parent company such as the business name, the address, the name of the owners, activities, the registered capital and the name of the representative of the branch.

It is good to know that the company registration process of a branch in Serbia in 2024 presents about the same attributes related to opening other types of companies in Serbia, with the difference that the parent company must provide complete information about the activities they intend to develop in the chosen country. Please keep in mind that as soon as the incorporation process took place, a statistical number and the registration certificate is provided to the newly-established branch in Serbia. Also, the next step in the branch formation in Serbia is to add a bank account that can be settled through a financial entity in the country or established in the home state, in order to perform the financial transactions related to the business.

Branches in Serbia must also consider the requirements linked to employment in the country, meaning that the staff needs to be registered with the Pension Fund, for Insurance and also for Social Security. For guidance and help in company registration in Serbia, we suggest you address to our local company incorporation agents in the country.

Serbia is among the preferences of foreign investors who want to expand their portfolios. Those who want to establish a company can also call on our accountants in Serbia to ensure that it is in line with the legislation in force. Our specialists can deal with aspects such as payroll, bookkeeping, and submission of annual financial statements. Also, they can maintain the company accounts, in terms of money transfers and more.

One of the obligations of branches in Serbia refer to having a legal address and maintaining the financial records in the firm. Here, a team of accounts in Serbia can provide the necessary services in this sense.

Here is a video presentation on this topic:

How can I open a bank account for a branch in Serbia?

For opening a bank account for a branch in Serbia, the company’s documents are necessary, plus varied forms offered by the chosen financial institution. A provisory bank account is necessary for depositing the minimum share capital. Also, there are several services like internet banking that can be offered for companies and owners in Serbia. Please bear in mind that our team of advisors can help you select the proper bank for your business and can provide you with complete assistance when opening the account.

The Companies Act in Serbia mentions that branches of foreign companies cannot have a foreign bank account to operate with. Giving the circumstances, there are no difficulties in opening a non-resident bank account in Serbia. Similarly, a branch can only use the property of the parent company, as ownership is prohibited.

Registering for taxes as a branch in Serbia

Once the branch in Serbia is registered with the institutions in charge, applying for tax purposes is the next step. Several documents need to be provided to the Tax Administration in Serbia before commencing the activities in Serbia. All the needed support for registering with the tax authorities and with any institution linked to the business in Serbia can be entirely provided by our team of company formation specialists, regardless of the chosen city for business incorporation.

The corporate tax rate in Serbia is 15% for branches registered in this country. As is known, branches in Serbia are considered permanent establishments and are subject to the taxation regime in this country.

Advantages of opening a branch in Serbia

The advantages of holding a branch in Serbia are especially of financial nature: if the country of origin has concluded a double tax avoidance agreement with Serbia, some of the withholding taxes on interests, royalties, and dividends may be avoided and the corporate taxes can be exempt or refunded. Another advantage is that there is no required minimum share capital at registration and the provided capital must be delivered by the foreign company. In case the foreign company enters the process of liquidation, the Serbian branch’s assets may be shared between the creditors if the debts cannot be paid.

The features of a Serbian branch

Forming a branch in Serbia in 2024 is not only an easy procedure but the choice of foreign companies and their representatives interested in establishing the activities in a fast, advantageous, and confident manner. The low expenses for opening a branch in Serbia and being under complete control of the parent company are among the characteristics considered by foreign enterprises looking to establish a business presence in this country. Such entities are normally represented by a person with residency in Serbia, however, you may address to our Serbian team of company incorporation agents if you would like to help you in this sense. Providing the existence of the foreign company is the main step linked to the incorporation of the branch in Serbia. Also, a branch is subject to the following matters:

- a bank account must be opened in the local currency, with complete support from our team of consultants;

- the Serbian Tax Administration is in charge of registering the branch for VAT purposes;

- each branch needs to have an office stamp for further contracts and documents;

- the person representing the branch in Serbia must provide a valid passport;

- a statement of the authorized person appointed by the foreign company for opening the branch in Serbia is necessary.

In case of branch closure, there is not a minimum period of time needed for such procedure. A confirmation letter issued by the tax administration in Serbia, with information that the respective branch has no debts or other financial obligations should be sufficient.

Regarding the minimum number of directors allowed for the branch in Serbia, one is enough to start this business and it is also valid for the minimum number of shareholders.

A virtual office for your branch in Serbia

There are often cases in which companies from abroad are interested in opening a branch without being interested in a traditional business office. A solution, in this case, is a virtual office that comes with a series of advantages like a notable business address, a virtual assistant in charge of the daily operations of the firm, phone, and mail forwarding and bank statement collection on request. Entrepreneurs should also consider the costs for a virtual office which are lower than the ones for opening a traditional office.

Purchasing a virtual office package in Serbia may represent the proper business solution for overseas companies wanting to establish a branch in the area of interest for marketing purposes and related projects. You can also talk to one of our specialists and find out the costs for virtual office services in Serbia. We remind that our Serbian team of consultants is ready to offer in-depth information about how to set up a branch and about the virtual office services you can purchase.

The obligations of branches in Serbia

The branch established in Serbia is managed by a representative invested with the power of attorney by a company in a foreign country. The approval from the foreign company must be received before major decisions are taken. The branch cannot acquire shares in another company without the consent of the parent company. Another requirement specific to the branches opened in this country is the obligation to register yearly the balance sheet and the statement of losses and profits of the foreign company at the Business Register Agency. The branch that was set up in Serbia must also keep its own financial statements and file them with the tax authorities every year. The VAT returns must be filed every month, just like any other local company.

For more details related to opening a branch in Serbia and the related requirements, you may contact our consultants in company formation in Serbia.