If you are a foreign investor who wants to enter the Serbian market without having to wait for company incorporation and the related procedures, you can buy a Serbian shelf company which is a ready-made enterprise. Considering the business field in which you are interested to activate, our company formation specialists in Serbia can help you purchase a shelf company and establish your activities in a fast and reliable manner.

| Quick Facts | |

|---|---|

| Legal entities available for shelf company | Limited liability company (DOO) |

|

Time required for purchasing the company |

A few days |

|

Types of features it includes (corporate bank account, VAT number, etc) |

– bank account, – tax number, – business name, – legal address |

| The advantages of a shelf company |

– fast purchase & ownership transfer, – access to bank loans, – varied activities |

| Appointing new directors |

Yes |

| Capital increase allowed |

Yes |

| Certificate of no commercial activities |

No |

| Modify the objects of activity | Yes |

| Participants in the purchase procedure | Buyer (or representative) & seller |

| The cost of buying a shelf company | Depends on the age and company formation fees |

Table of Contents

Why should you purchase a shelf company in Serbia?

The stable economy and the fast development of the main industries in Serbia have made foreigners concentrate on the business climate and the related conditions of this country. In this matter, instead of establishing a company from scratch, a business person can choose to buy a shelf company in Serbia which represents an enterprise ready to activate on the market. As soon as the business field has been selected, it is then easy to purchase a ready-made company and start the activities.

What is a shelf company?

Shelf companies are registered enterprises kept on a shelf and ready to be transferred to owners wanting to enter the Serbian market. These are also known as ready-made companies or vintage companies due to their special attributes. Ready-made companies in Serbia are preferred in most of the activities in this country, as long as they are stipulated by the Commercial Code in Serbia.

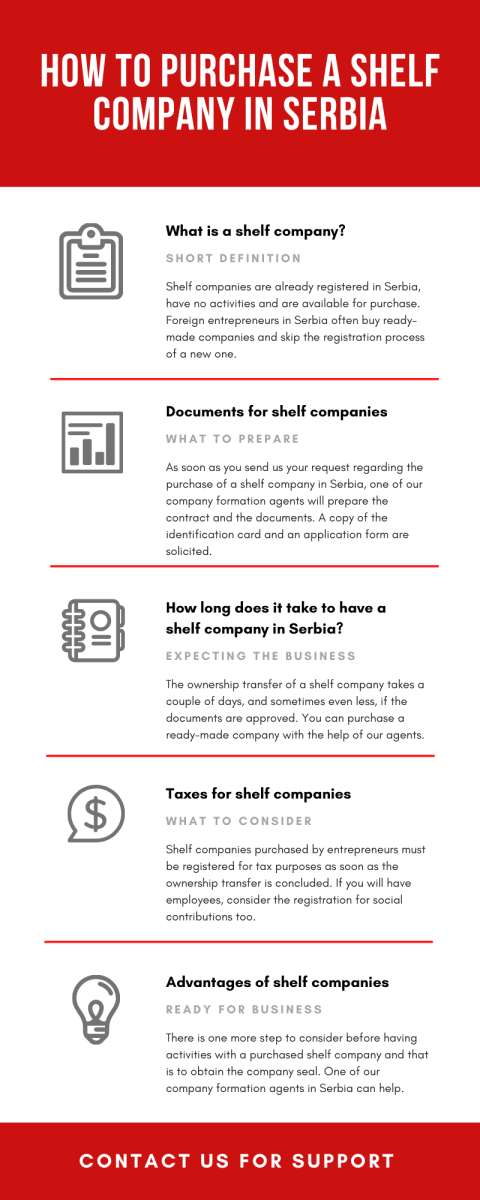

Checking the history and the documents of such company are subjects in which you may address to our Serbian specialists in company incorporation who can provide you with the necessary information and guidelines. In accordance with a businessman’s requests, our team can offer support in establishing the conditions of acquiring the shelf company. Here is an infographic about how to purchase a shelf company in Serbia:

Who can buy shelf companies in Serbia?

Whether you are a big entrepreneur or a small businessman, you can purchase a shelf company and benefit from the advantages of such a structure. Also, vintage companies direct to both nationals or investors from abroad with interests in setting up their operations in a fast manner.

The benefits of a shelf company in Serbia

Being a ready-made company, the buyer won’t have to deal with the hassle of opening a bank account, as this procedure is already established. Furthermore, a shelf company in Serbia is an aged business which offers more credibility on the market compared to the newly registered companies. Also, you can consider the following advantages of such businesses:

- these companies are not subject to debts, loans, and other related obligations;

- investors can commence the activities as soon as the ownership of the business has been concluded with the Serbian Trade Register;

- the accounting history of vintage companies is no less than two years;

- ready-made companies in Serbia are trustworthy in front of the banks.

The following video presentation contains information about shelf companies in Serbia:

Are there any risks at the time of buying a shelf company?

Even though a ready-made company is the type of business which doesn’t have any activities and therefore no liability, it suggested to have a background check. If the verifications reveal the fact that the company had labor law obligations or particular taxation problems, the new management can be liable for such matters. It is recommended to observe if there are any debts and if the accountancy documents are in order. We remind that a background analysis of a shelf company in Serbia can be solicited to our team of company incorporation representatives in Serbia.

International investors have at their fingertips a series of business opportunities in Serbia, from which to choose depending on the established plans. However, accounting support is also needed so that the company’s operations do not run into irregularities. Thus, we recommend the services of our accountants in Serbia who can handle tasks such as payroll, HR management, bookkeeping, and more.

How long does it take to buy a shelf company in Serbia?

There is no need to wait for the incorporation of a ready-made company in Serbia, as this structure is already registered with the Serbian authorities. However, the ownership transfer might take a few days, in order for all the documents to be assigned to the new proprietors of the company before it goes on the market. Please feel free to talk o our advisors and check the requirements for purchasing a shelf company in Serbia. Our team can also help you register the company for VAT.

The list of shelf companies in Serbia

The registering authorities of businesses in Serbia can provide a list of shelf companies which are ready for the new ownership. Depending on the type of activities a foreign entrepreneur wants to introduce on the Serbian market, one can purchase the kind of business he/she is interested in. Most of the shelf companies are registered as limited liability companies, the common business structure that suits the needs of many investors.

Company due diligence in Serbia

Even though ready-made companies present confidence in front of buyers, there are cases in which a potential vintage company owner might ask for company due diligence and a series of verifications that come with such measure. A company due diligence procedure offers an accurate report that can reveal if there are any issues or hidden problems. The company background is verified with this kind of procedure, while the risks and advantages are taken into account. Vintage companies are only registered and have no activities, and therefore no debts or liabilities.

So, in most cases, a company due diligence will only reveal this kind of report. However, such practice might come to the attention of entrepreneurs who want to buy a shelf company in Serbia. If you believe that a company due diligence process will provide you extra protection prior to the acquisition of a shelf company, you can talk to our company formation specialists in Serbia and ask for assistance.

Sectors in which a shelf company can activate

Ready-made companies can activate in all sectors of interest in Serbia, except the ones where state restrictions are imposed. A shelf company can be bought by entrepreneurs interested in activating in the manufacturing sector, tourism, business management, insurance, finance, FMCG, and many more. Being an already registered company, the activities can start quite fast, as soon as the ownership transfer is concluded.

Foreign entrepreneurs who decided on the type of activity for entering the business market in Serbia can speak to one of our company formation specialists. We can provide complete assistance and guidance for all the formalities involved in company registration in Serbia as we work closely with the authorities in charge of company incorporation.

Tax registration for shelf companies in Serbia

The registration for taxation of a shelf company in Serbia can be made as soon as the ownership transfer is made. All companies with activities in Serbia must pay taxes on the profits, therefore, whether you want to create a company or buy a ready-made one, the registration is mandatory. The VAT and the corporate income tax are the most important taxes in Serbia, but for more details in this matter, you are invited to talk to our specialists.

FAQ about shelf companies in Serbia

1. Who can buy shelf companies in Serbia?

Shelf companies can be purchased by both local and foreign entrepreneurs in Serbia. There are no restrictions for businessmen in this country, except the ones referring to financial crimes.

2. Are shelf companies mentioned by the Commercial Code in Serbia?

Yes, vintage companies are mentioned by the Commercial Code in Serbia and work under the rules of limited liability companies. Ready-made companies come with many advantages.

3. How long does it take to own a shelf company in Serbia?

The ownership transfer of a shelf company is normally acquired in a couple of days or less. Once the documents are accepted, the procedures can commence.

4. Do shelf companies have liabilities?

No, shelf companies are only registered and have no activities on the market. Having no financial activities means there are no debts involved, so from this point of view, the acquisition is safe.

5. Do I need to register a shelf company for taxation in Serbia?

Yes, the registration for taxation can be made after the ownership transfer is concluded. Companies in Serbia must pay taxes imposed on profits.

Investments in Serbia

Serbia hosts a large number of foreign entrepreneurs who already thrive in the country. There is plenty of space for any investor who wants to set up his/her activities in different domains. Plus, the business attributes and advantages in Serbia are quite considered at the time of investments. The country provides a great tax system, infrastructure, a strategic location among European countries, a skilled workforce, a series of bilateral agreements signed, and the protection against the fiscal evasion with the help of the double taxation treaties signed with countries worldwide. Here are some facts and figures about the business and economy of Serbia:

- The 2020 Doing Business report ranks Serbia 44th out of 190 economies in the world.

- Around USD 44 billion was the total FDI stock for Serbia in 2019.

- Around 70% of the foreign investments come from EU countries in Serbia.

- About 56% of the greenfield projects registered in Serbia in 2019 was directed to the manufacturing sector.

- Serbia has one of the lowest corporate tax rates in Europe, set at 10%.

If you want in-depth information about the shelf companies in Serbia, we invite you to contact our team of company formation representatives in Serbia.