The limited liability company in Serbia or the D.O.O. (društvo sa ograničenom odgovornošću) can be easily set up by foreigners interested in doing business in an appreciated environment. This is the most popular business structure in Serbia, but instead of dealing with misunderstandings or language barrier, we suggest you address your inquiries to our team of company formation specialists in Serbia. Our team can handle the registration process with the authorities in charge and can also represent the company’s activities in a legal manner.

Table of Contents

How can I register a D.O.O. in Serbia in 2024?

The first step for opening a D.O.O in Serbia in 2021 is choosing a proper name, checking it via the Internet on the Business Registers Agency and appoint a director. The name of the future company can be reserved by a prospective applicant by submitting a special application. The reservation is valid for 60 days and it can be transferred to another businessman or renewed if appropriate. A private limited liability company in Serbia is a company based on a share capital of RSD 100 (EUR 1) and with a maximum of 50 shareholders.He/ she can be the founder or even a part-time worker if it is specified in the Articles of Incorporation. An OP form with his/her signature as a company responsible must be certified.

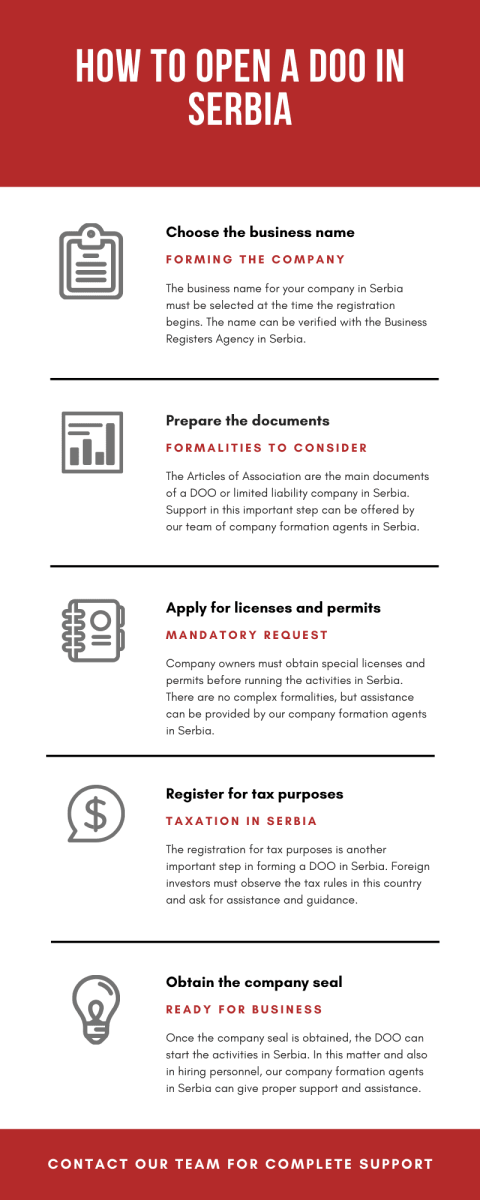

When choosing the main activity domain of the DOO, the entrepreneur must consult the laws on the classification of business activities and on the registry of categories. This is necessary because approvals need to be received from the competent authorities according to the field of activity. At least half of the minimum share capital must be deposited in a temporary bank account. The Articles of Association containing the above information must be legalized. If you would like toknow more about how to open a DOO in Serbia in 2024 you can also see the following infographic:

The administration costs for a DOO in Serbia can be approximately EUR 50, the fee to be paid to the Serbian Trade Register. Here is added a cost of EUR 30 – EUR 50 for the preparation of the LLC establishment documents in Serbia.

Documents to be submitted for opening an LLC (DOO) in Serbia

A number of taxes must be paid before company registration and receiving the company identification number. These taxes must be paid at the Serbian Business Registers Agency and the Republic Statistical Office. The registration process can be performed electronically, but the representative of the company has the obligation to submit the original documents within five days of the application. Along with the registration form, the founder must deposit the following:

- an ID proof and the signed Articles of Incorporation of the future company;

- a proof from the bank certifying that the minimum share capital was deposited;

- a decision of the representative agent with residency in the chosen city for business;

- the authorized signature of the owners and the managers of the company.

If Serbia is the business destination for your next activities, we recommend the services offered by our accountants in Serbia. They can deal with bookkeeping, payroll, tax advice and compliance and the correct management of company accounts. We are here to guide your business, from an accounting point of view, towards the best results.

The new amendments of Law on Investments 2015 mentions varied investment approaches. As such, many changes have pointedly removed the variances between foreign and domestic entrepreneurs and their legal status. Therefore, the company registration procedure in Serbia is fast and reliable for all types of investors, particularly for LLCs.

Details about the business name reservation

When deciding on business in Serbia, the incorporation starts with choosing the structure and reserve a name for the company. A verification in this sense to see if the name you wish to choose is available starts with the Serbian Business Registers Agency, the same institution that approves the name of the company.

The Companies Act in Serbia stipulates that the name of the company must be unique and must not contain any offensive words or the ones restricted by the law. An application for reserving a name needs to be submitted to the Serbian Business Registers Agency. We mention that this reservation is available for 60 days, sufficient time for an entrepreneur to incorporate a company in Serbia.

How can I register for taxes in Serbia in 2024?

The next important step after the company is registered in Serbia is to register for tax purposes in this country, in order to properly start the activities in 2024. Our team of consultants in Serbia is at your disposal with complete support for drafting the necessary documents for tax registration to the Serbian Tax Administration. Talk to our agents if you need help for tax registration in 2024 in Serbia.

15% is corporate tax in Serbia, while standard VAT is 20%. However, there are also lower VAT rates, depending on the categories of products and services intended for consumers and final customers.

When registering an LLC in Serbia, one should ensure that the business operations align with and register with appropriate government authorities: the Ministry of Economy, the Serbian Chamber of Commerce, and the National Bank of Serbia.

What is a digital signature?

A digital signature is necessary for approving all sorts of financial documents and statements in the company and it is normally assigned to the managers of the firm. In this sense, our team of accountants can make the necessary preparations for obtaining a digital signature.

When forming an LLC in Serbia, one should note that there is no fixed timeline in this sense. In many cases, it all depends on numerous aspects, like name verification and reservation, obtaining the VAT ID, and/or issuing the business license required.

Accounting services for your DOO in Serbia

If you have decided for externalizing the accounting services for your firm, we are at your disposal with complete support in this sense, as we can handle all the requirements in respect to the International Financial Reporting Standards and the applicable legislation in Serbia. Your DOO in Serbia can receive payroll services, bookkeeping, support for VAT registration and for submitting the annual financial statements in compliance with the local laws.

As additional accounting services, it is best to solicit tax planning and consultancy for your company in Serbia, and bear in mind that tax minimization methods might be necessary for cutting the expenses in the firm, from a taxation point of view. Regardless of the chosen business structure, whether you intend to open a DOO in Serbia or any other type, you should talk to us and find out information about the accounting services available for your firm. We can also help you with legal services provided by our local partners.

Post-registration of a DOO in Serbia

As soon as the company’s documents have been accepted by the authorities, the next step is to observe the post-registration procedures and apply for the company’s seal, taxes, and social contributions. Please observe the following conditions:

- the founder must specify the way he/she wants to receive the Decision on Founding;

- the Decision is ready for collection in a maximum five days if all the submitted data are correct;

- a company seal must be used in every company’s activities, so the next step after receiving the Decision on Founding is making one;

- after receiving the company seal, the representatives must apply for the local taxes. The procedure will not take longer than approximately 3 days;

- the day the application is filed, an inspector is sent to the company’s office who verifies the Decision of Registration and the basis for using that location as headquarter;

- after receiving the TIN (Taxpayer Identification Number), the DOO must open a permanent bank account, a process that usually takes one day;

- the last step in incorporating a limited liability company in Serbia is recording the workers’ contracts at the Employment Fund.

The registration for VAT in Serbia is mandatory for companies in this country. One of our advisors can provide complete support.

How can I open a bank account for a DOO in Serbia?

In order to draft the minimum share capital of the limited liability company you wish to set up in Serbia, a bank account must be opened in this country. In this sense, the company’s main documents are sufficient for the chosen bank. The procedure might take a few days until the bank account is linked to the enterprise you want to open in Serbia.

Can I ask for virtual office services in Serbia?

Yes, foreign investors who want to open DDOs in Serbia can ask for virtual office services if they want to control the operations from abroad. Phone and fax forwarding, a local phone number, mail collection and forwarding, meeting rooms for clients and collaborators are among the services offered through a virtual office in Serbia. Please note that our Serbian team of company formation agents can offer in-depth information about how to benefit from virtual office services.

Advantages of incorporating a DOO in Serbia

The limited liability company is a widely used legal entity for starting a business in Serbia. There are several advantages of incorporating a DOO in Serbia:

- time efficiency – it only takes three weeks to incorporate it;

- share capital – a minimum amount of EUR 1;

- directors – there is a need for only one director of any nationality;

- shareholders – the basic requirements for starting a D.O.O in Serbia are two shareholders of any nationality;

- taxes – Serbia is an attractive business environment since it promotes one of the lowest corporate tax rates in Europe (15%);

- legislation – the Serbian authorities have adopted new measures for simplifying and advancing the process of company registration in Serbia by unifying the Register for all business entities.

If you need more details about how you can open a DOO (LLC) in Serbia, don’t hesitate to contact our specialists in company formation in Serbia.